Financial Stress Problems: Understanding And Overcoming Money-Related Worries:

Financial Stress Problems: Understanding And Overcoming Money-Related Worries:

Introduction

In today’s world, money plays a central role in almost every aspect of life. Whether it is paying bills, managing household expenses, or planning for the future, finances influence our daily choices. When money becomes a source of constant worry, it leads to what we call financial stress problems.

These problems are not just about numbers in a bank account; they affect our mental health, physical well-being, and relationships. By understanding the nature of financial stress problems and their impact, we can learn to manage them better and live with more balance.

What Are Financial Stress Problems?

Financial stress problems refer to the emotional, mental, and physical strain caused by money-related worries. People facing debt, job insecurity, rising expenses, or lack of savings often feel overwhelmed.

Unlike temporary money concerns, financial stress problems can become chronic if not managed properly. They create a constant cycle of anxiety, sleepless nights, and even health issues. Recognizing these problems is the first step toward addressing them.

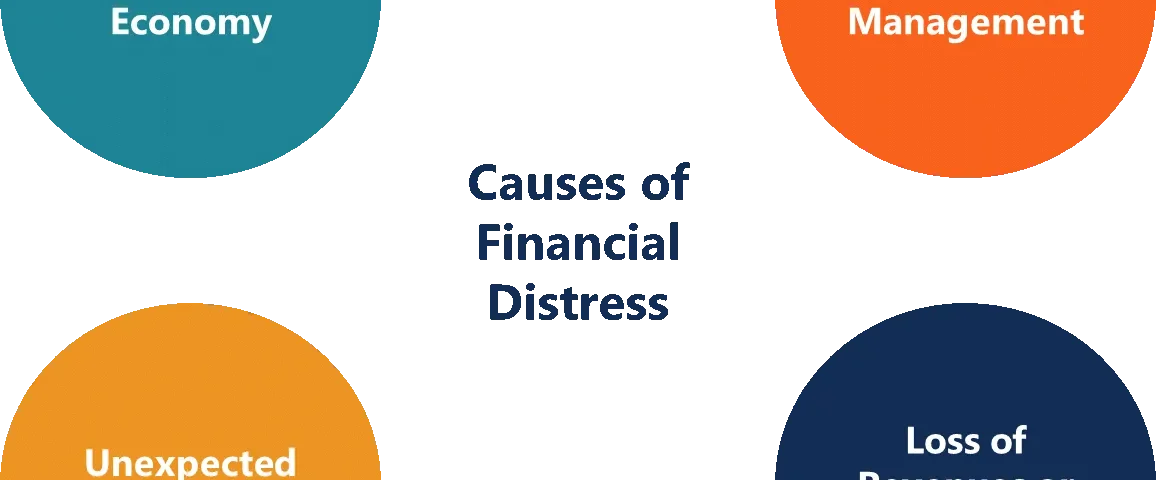

Common Causes of Financial Stress Problems:

- Job Loss or Unstable Income

Losing a job or having irregular income is one of the biggest financial stress problems. Without a steady paycheck, people struggle to cover basic needs, which leads to worry and panic.

- Rising Living Costs

Inflation and increased living costs are major drivers of financial stress problems. Higher prices for food, fuel, education, and healthcare put pressure on families every month.

- Debt and Loans

Unpaid debts, credit card bills, and loans are strong contributors to financial stress problems. The fear of default or dealing with creditors can cause sleepless nights.

- Lack of Savings

Not having an emergency fund creates insecurity. Unexpected expenses like medical emergencies or home repairs highlight the seriousness of financial stress problems.

- Family Responsibilities

Providing for children’s education, marriage expenses, or supporting elderly parents often increases financial stress problems in households.

Impact of Financial Stress Problems

On Mental Health

Financial stress problems are closely linked to anxiety, depression, and constant worry. People under financial strain often feel trapped and hopeless.

On Physical Health

Stress caused by financial worries can lead to headaches, high blood pressure, insomnia, and even heart disease. Financial stress problems weaken the immune system and increase health risks.

On Relationships

Arguments over money are one of the leading reasons for family conflicts. Couples facing financial stress problems often report communication breakdowns and emotional distance.

https://www.helpguide.org/mental-health/stress/coping-with-financial-stress

On Work Productivity

When employees carry financial stress problems into the workplace, their concentration, creativity, and efficiency suffer. This creates a negative cycle that further impacts income

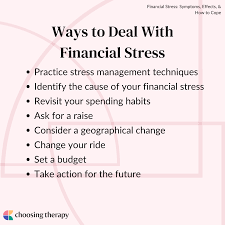

How to Manage Financial Stress Problems?

Living with financial stress problems can feel overwhelming, but the good news is that they can be managed step by step. Money worries are often made worse by lack of planning, sudden expenses, or emotional reactions. By learning simple strategies, we can reduce financial anxiety and create a sense of stability. Below are detailed methods to manage financial stress problems effectively.

1. Create a Realistic Budget

Budgeting is the foundation for controlling financial stress problems. A realistic budget allows us to see where money is coming from and where it is going.

- Write down all income sources and expenses.

- Categorize expenses into “needs” (rent, bills, groceries) and “wants” (entertainment, luxury shopping).

- Track spending daily to avoid surprises at the end of the month.

- Set aside a small portion for savings, even if it is only a little.

When we budget, we regain control over money, and that directly reduces financial stress problems.

2. Build an Emergency Fund

One of the major reasons for financial stress problems is the lack of preparation for sudden expenses. Car repairs, medical emergencies, or job loss can create panic. An emergency fund provides security.

- Start small by saving even 5–10% of income.

- Keep this fund separate from daily use accounts.

- Aim for at least three to six months of living expenses.

Having this backup reduces anxiety and provides peace of mind when facing unexpected events.

3. Avoid and Reduce Debt

Debt is one of the most powerful triggers of financial stress problems. High-interest loans and credit card bills can feel like a never-ending cycle.

- Pay off debts with the highest interest first.

- Avoid borrowing for unnecessary purchases.

- Negotiate with lenders for better repayment terms.

- Use cash instead of credit where possible.

By reducing debt step by step, we lower stress levels and regain control over finances.

4. Improve Financial Literacy

A lack of knowledge is one of the hidden financial stress problems. Many people struggle with money management simply because they don’t understand banking, savings, or investment options.

- Read books or articles on personal finance.

- Take short online courses about budgeting and saving.

- Consult financial experts when making big decisions.

The more we learn, the more confident we become in handling money, which directly reduces financial stress problems

5. Seek Professional Guidance

Sometimes, the burden of financial stress problems becomes too heavy to manage alone. Professional guidance can make a huge difference.

- Financial advisors can create repayment and investment plans.

- Debt counselors help negotiate with creditors.

- Therapists and counselors can address the emotional toll of money worries.

Getting expert help prevents small problems from growing into lifelong struggles.

6. Strengthen Emotional Well-Being

Financial stress problems do not only affect wallets; they affect minds. Stress relief practices are essential.

- Practice meditation, yoga, or deep breathing.

- Exercise regularly to release stress hormones.

- Talk with family or friends about worries instead of keeping them inside.

- Limit negative thinking by focusing on solutions instead of problems.

A calm mind makes better financial decisions.

7. Manage Time Effectively

Time mismanagement often increases financial stress problems. Procrastinating on bills, delaying payments, or ignoring planning causes more pressure later.

- Pay bills on time to avoid penalties.

- Set reminders for due dates.

- Plan weekly check-ins with your budget.

- Break large tasks (like debt repayment) into smaller, manageable steps.

When time is well-managed, financial tasks become lighter and less stressful.

8. Build Healthy Lifestyle Habits

It may sound unrelated, but unhealthy lifestyles worsen financial stress problems. Poor sleep, lack of exercise, and bad diet make the mind more vulnerable to anxiety.

- Sleep at least 7–8 hours to stay focused.

- Eat nutritious foods to keep energy stable.

- Avoid overspending on unhealthy habits like smoking, excessive caffeine, or fast food.

A strong body supports a strong mind, which helps handle financial stress better.

9. Strengthen Family Communication

Arguments over money are one of the biggest financial stress problems in households. Lack of communication makes it worse.

- Discuss income and expenses openly with family.

- Plan financial goals together.

- Teach children about money management early.

- Avoid blaming each other for financial struggles.

Teamwork in the family reduces the emotional burden and creates unity in solving problems.

10. Take Small but Consistent Steps

Many people think financial stress problems can only be solved with big changes. In reality, small consistent actions bring the best results.

- Save a little each week.

- Cut one unnecessary expense at a time.

- Increase income with part-time work or side hustles.

- Celebrate small wins, like paying off a small debt.

Consistency turns financial stress into financial control.

Summary

Managing financial stress problems is not about getting rich overnight; it is about creating balance, planning wisely, and protecting mental health. By budgeting, saving, avoiding debt, improving knowledge, and strengthening emotional well-being, anyone can reduce money-related stress. With patience and consistency, financial worries become manageable, and life becomes more stable and peaceful.

FAQs

Q1: What are the main causes of financial stress problems?

The main causes include job loss, rising costs, debt, lack of savings, and family responsibilities.

Q2: Can financial stress problems affect health?

Yes, they can cause insomnia, anxiety, depression, heart issues, and weakened immunity.

Q3: How can I overcome financial stress problems quickly?

By budgeting, reducing debt, building savings, and seeking support, financial worries can be reduced step by step.

Q4: Do financial stress problems affect relationships?

Yes, arguments about money are one of the leading reasons couples experience conflict and distance.

Conclusion

Financial stress problems are one of the biggest challenges of modern life. They affect not just our wallets but our minds, bodies, and relationships. However, with proper planning, healthy habits, and the right guidance, these problems can be managed. Instead of allowing money worries to control us, we can take steps toward financial stability and emotional well-being. The key is awareness, action, and patience.