Emergency Fund For Stress Relief: Why It Matters And How To Build One:

Money worries are one of the biggest reasons behind anxiety in modern life. Many people lose sleep over unexpected expenses such as medical bills, car repairs, job loss, or sudden family emergencies. In such situations, an emergency fund for stress relief becomes a life-saving financial tool. It not only provides financial backup but also reduces the mental pressure that comes with uncertainty.

What Is an Emergency Fund?

An emergency fund is a savings account or a separate amount of money set aside to cover unplanned expenses. The purpose of an emergency fund for stress relief is not luxury spending or entertainment but to create a safety net. It gives us peace of mind that we can manage life’s sudden challenges without borrowing money or falling into debt.

We often feel anxious when we don’t have control over our finances. By building an emergency fund for stress relief, we reduce the fear of “what if.” For example:

Why an Emergency Fund Reduces Stress”

Stress often comes from uncertainty. When we don’t know how we will manage unexpected expenses like medical bills, car repairs, or sudden job loss, our mind stays under constant pressure. This is where an emergency fund reduces stress because it provides a financial safety net that gives both emotional and practical relief.

1. Provides Financial Security

The biggest reason an emergency fund reduces stress is that it creates a sense of security. Knowing that we have money set aside for emergencies helps us feel more confident in handling life’s surprises without borrowing or panicking.

2. Prevents Debt and Loan Pressure

Without savings, we often rely on loans, credit cards, or borrowing from others during emergencies. This creates extra debt and guilt, which increases stress. Having an emergency fund means we can cover urgent expenses without falling into debt traps.

3. Supports Mental Health

Money problems directly affect our mental health. Anxiety, sleeplessness, and constant worry often come from financial instability. When we know an emergency fund reduces stress, we realize it actually protects our mental health by reducing financial anxiety.

4. Gives Freedom to Focus on Solutions

When emergencies happen, stress clouds our decision-making. But if we already have savings, we can focus on solving the problem instead of worrying about “how to pay for it.” This clear mindset itself reduces stress.

https://www.investopedia.com/terms/e/emergency_fund.asp

5. Builds Confidence and Control

One of the biggest emotional benefits of an emergency fund is the feeling of control. Instead of being at the mercy of uncertain events, we feel prepared. This preparedness helps us believe that we can handle challenges calmly.

Knowing that money is available for such situations immediately lowers stress and creates mental stability Experts suggest that an emergency fund for stress relief should cover at least 3 to 6 months of living expenses. That includes:

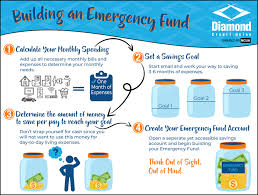

How Much Should We Save in an Emergency Fund?

An emergency fund is our financial safety net. It protects us during unexpected life events like sudden medical bills, job loss, home repairs, or car breakdowns. But one common question people ask is: How much should we save in an emergency fund?

The answer depends on our lifestyle, income, and responsibilities, but there are some general rules that can guide us.

- The 3 to 6 Months Rule

Most financial experts recommend saving at least 3 to 6 months’ worth of essential living expenses. This means if we spend $1,000 a month on basics like rent, food, and utilities, we should aim for $3,000 to $6,000 in our emergency fund.

- 3 months → Good for people with a stable job and fewer financial dependents.

- 6 months → Better for people with families, variable income, or unstable job security.

This range ensures that if something unexpected happens, we have enough to survive without falling into debt.

- Start Small if Need

Saving a large amount can feel overwhelming, but we don’t need to build it overnight. Even saving $10–$50 a week can add up over time. The key is consistency. Starting small still reduces stress because it builds a habit of financial discipline.

- Adjust Based on Lifestyle

The exact amount we should save depends on our personal situation:

- Single person with stable job → 3 months’ expenses may be enough.

- Family with kids → At least 6 months or more.

- Self-employed/freelancer → 6 to 12 months, since income can be irregular.

- High medical needs → More savings, because emergencies can be costly.

- Calculate Real Needs

To know how much to save, we must calculate essential monthly expenses, including:

- Rent or mortgage

- Utilities (electricity, water, gas, internet)

- Groceries

- Transportation/fuel

- Health insurance/medicine

- Loan payments (if any)

Multiplying this number by 3 to 6 gives a clear savings target.

- Keep It Separate and Accessible

An emergency fund should be kept in a separate savings account, not mixed with regular spending money. It must be easily accessible in emergencies but not too easy to spend on daily wants.

- Review and Update Regularly

Life changes. New job, family growth, or moving to a new city can increase expenses. That’s why we should review our emergency fund at least once a year and adjust according to our updated needs.

The amount may vary depending on lifestyle, income stability, and family size.

Steps to Build an Emergency Fund

Creating an emergency fund for stress relief may sound difficult, but small steps can make it possible:

- Start Small – Even saving a little every week adds up over time.

- Set Clear Goals – Decide how much you want to save (e.g., $1000 as a starter).

- Cut Unnecessary Expenses – Reduce dining out, subscriptions, or impulse shopping.

- Automate Savings – Transfer a fixed amount into your emergency account monthly.

- Avoid Using It for Non-Emergencies – Only touch it in real emergencies.

Where to Keep an Emergency Fund

To make an emergency fund for stress relief effective, keep it in a safe and accessible place such as:

- High-yield savings account

- Separate bank account

- Money market account

It should be easily available but not too tempting for daily use.

Psychological Benefits of an Emergency Fund

Having an emergency fund for stress relief is not just about money—it’s about mental health. It reduces:

- Anxiety about future expenses

- Depression linked to financial struggles

- Panic during sudden life changes

- Family conflicts caused by money problems

When finances are stable, our mind feels calmer, relationships improve, and confidence grows.

Common Mistakes to Avoid

While building an emergency fund for stress relief, avoid these mistakes:

- Using the fund for vacations or luxury shopping

- Not refilling the fund after using it

- Mixing it with regular spending accounts

- Depending only on credit cards instead of savings

How an Emergency Fund Builds Long-Term Security?

An emergency fund is one of the most important financial foundations we can create for ourselves. It acts like a safety net, designed to protect us during unexpected events such as job loss, medical emergencies, or sudden expenses. Many people only see it as short-term relief, but in reality, an emergency fund plays a much bigger role—it builds long-term financial security and ensures stability in our lives.

Let’s break down how this works in detail.

1. Protection against Debt

One of the greatest threats to financial security is debt. Without an emergency fund, most of us rely on credit cards, payday loans, or borrowing from others when something unexpected happens. This debt grows with high interest rates, making it harder to recover in the future.

But if we have an emergency fund, we use our own money instead of borrowing. That means no new debt, no interest payments, and no long-term financial burden. Over time, this protection keeps us stable and secure.

2. Peace of Mind during Job Loss

Losing a job can create panic and fear, especially when bills keep coming. Without savings, we may be forced to take the first available job, even if it pays less or does not fit our skills.

An emergency fund gives us breathing space. It allows us to cover expenses for a few months, giving us time to find the right job instead of rushing. This ensures long-term career growth and stability.

3. Security in Health Emergencies

Unexpected health issues can happen to anyone. Even with medical insurance, there are out-of-pocket costs—like medicines, transport, or special treatments—that insurance may not cover.

Having an emergency fund ensures that we can take care of our health immediately without delay. This prevents small health issues from turning into major problems. In the long run, this keeps both our health and finances secure.

4. Protecting Future Goals

Long-term financial security also means protecting future goals such as buying a house, sending children to school, or retiring comfortably. Without an emergency fund, we may be forced to withdraw money from retirement savings or investment accounts during a crisis.

This damages future wealth. But with an emergency fund, we keep our long-term savings untouched and on track. That means future goals remain safe.

5. Reducing Stress and Improving Mental Health

Financial stress is one of the most common causes of anxiety. Living paycheck to paycheck means that one small emergency can ruin our peace of mind.

When we know that an emergency fund is there, we feel more confident and relaxed. Less stress improves our mental health, productivity, and decision-making. In the long run, this creates stability in both financial and personal life.

6. Giving Freedom to Take Smart Risks

Long-term growth often requires taking risks—like starting a business, switching careers, or investing in opportunities. But without a safety net, these risks can feel too dangerous.

An emergency fund acts as a backup plan. Even if things don’t go as planned, we know we won’t fall into financial chaos. This financial security allows us to move forward with confidence.

7. Preventing Small Problems from Growing

A small car repair or a minor home expense may not sound big, but if we can’t pay for it immediately, it can lead to bigger issues like unpaid bills, penalties, or even loss of property.

An emergency fund helps us solve these small problems quickly. This prevents them from turning into long-term financial disasters.

8. Building Strong Saving Habits

Contributing regularly to an emergency fund also creates a habit of saving. This habit becomes a part of our lifestyle and slowly builds a culture of financial discipline. Over time, it not only keeps us prepared for emergencies but also strengthens our long-term wealth.

How Much Should We Save in an Emergency Fund?

An emergency fund is our financial safety net. It protects us during unexpected life events like sudden medical bills, job loss, home repairs, or car breakdowns. But one common question people ask is: How much should we save in an emergency fund?

The answer depends on our lifestyle, income, and responsibilities, but there are some general rules that can guide us.

- The 3 to 6 Months Rule

Most financial experts recommend saving at least 3 to 6 months’ worth of essential living expenses. This means if we spend $1,000 a month on basics like rent, food, and utilities, we should aim for $3,000 to $6,000 in our emergency fund.

- 3 months → Good for people with a stable job and fewer financial dependents.

- 6 months → Better for people with families, variable income, or unstable job security.

This range ensures that if something unexpected happens, we have enough to survive without falling into debt

- Start Small if Needed

Saving a large amount can feel overwhelming, but we don’t need to build it overnight. Even saving $10–$50 a week can add up over time. The key is consistency. Starting small still reduces stress because it builds a habit of financial discipline.

- Adjust Based on Lifestyle

The exact amount we should save depends on our personal situation:

- Single person with stable job → 3 months’ expenses may be enough.

- Family with kids → At least 6 months or more.

- Self-employed/freelancer → 6 to 12 months, since income can be irregular.

- High medical needs → More savings, because emergencies can be costly

- Calculate Real Needs

To know how much to save, we must calculate essential monthly expenses, including:

- Rent or mortgage

- Utilities (electricity, water, gas, internet)

- Groceries

- Transportation/fuel

- Health insurance/medicine

- Loan payments (if any)

Multiplying this number by 3 to 6 gives a clear savings target.

- Keep It Separate and Accessible

An emergency fund should be kept in a separate savings account, not mixed with regular spending money. It must be easily accessible in emergencies but not too easy to spend on daily wants.

- Review and Update Regularly

Life changes. New job, family growth, or moving to a new city can increase expenses. That’s why we should review our emergency fund at least once a year and adjust according to our updated needs.

FAQs on Emergency Funds

Q1: How quickly should I build an emergency fund?

Ans: Start immediately, even if it’s small. Consistency matters more than speed.

Q2: Can I use investments instead of cash savings for emergencies?

Ans: No. Investments may lose value or take time to withdraw. An emergency fund for stress relief should always be liquid.

Q3: What if I can’t save much due to low income?

Ans: Start with whatever is possible—$5, $10, or $20 a week. Over time, it will grow.

Q4: Should couples or families have separate funds?

Ans: Ideally, families should have a joint emergency fund for stress relief that covers shared expenses.

Conclusion

Life is full of uncertainties, but we can prepare for them. Building an emergency fund for stress relief is one of the smartest ways to handle financial shocks and protect our mental well-being. With consistent savings, discipline, and smart planning, we can overcome money-related stress and live with greater peace of mind.